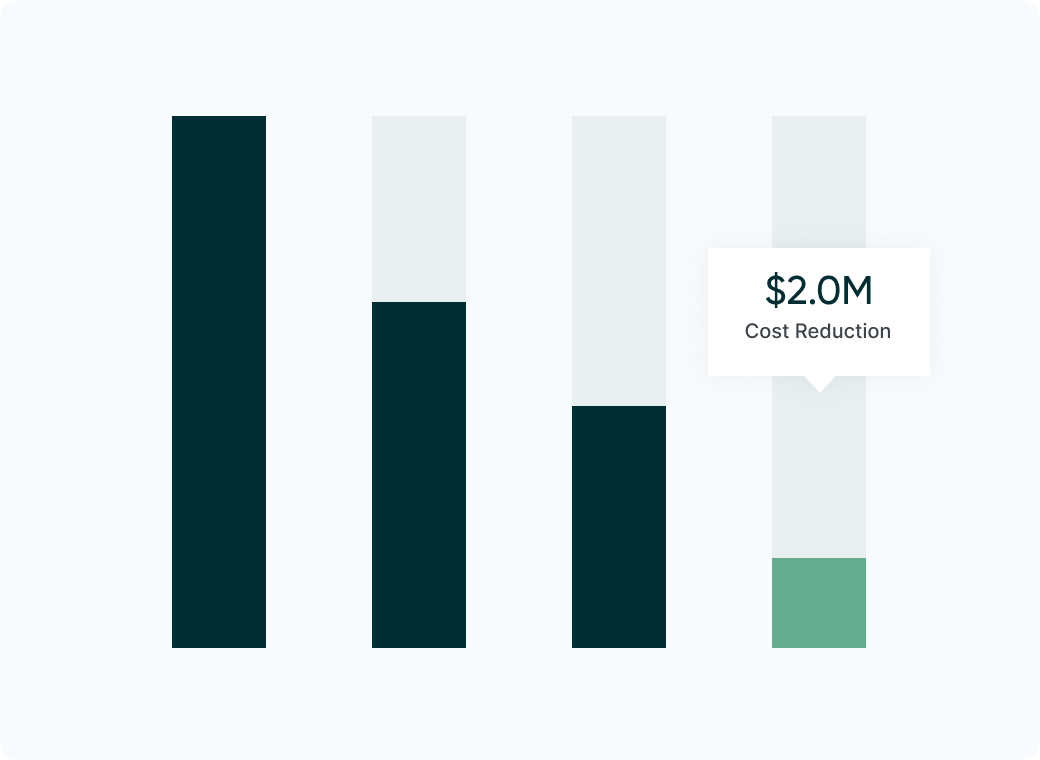

Helping global customers save millions of dollars

Purpose-built to save companies money

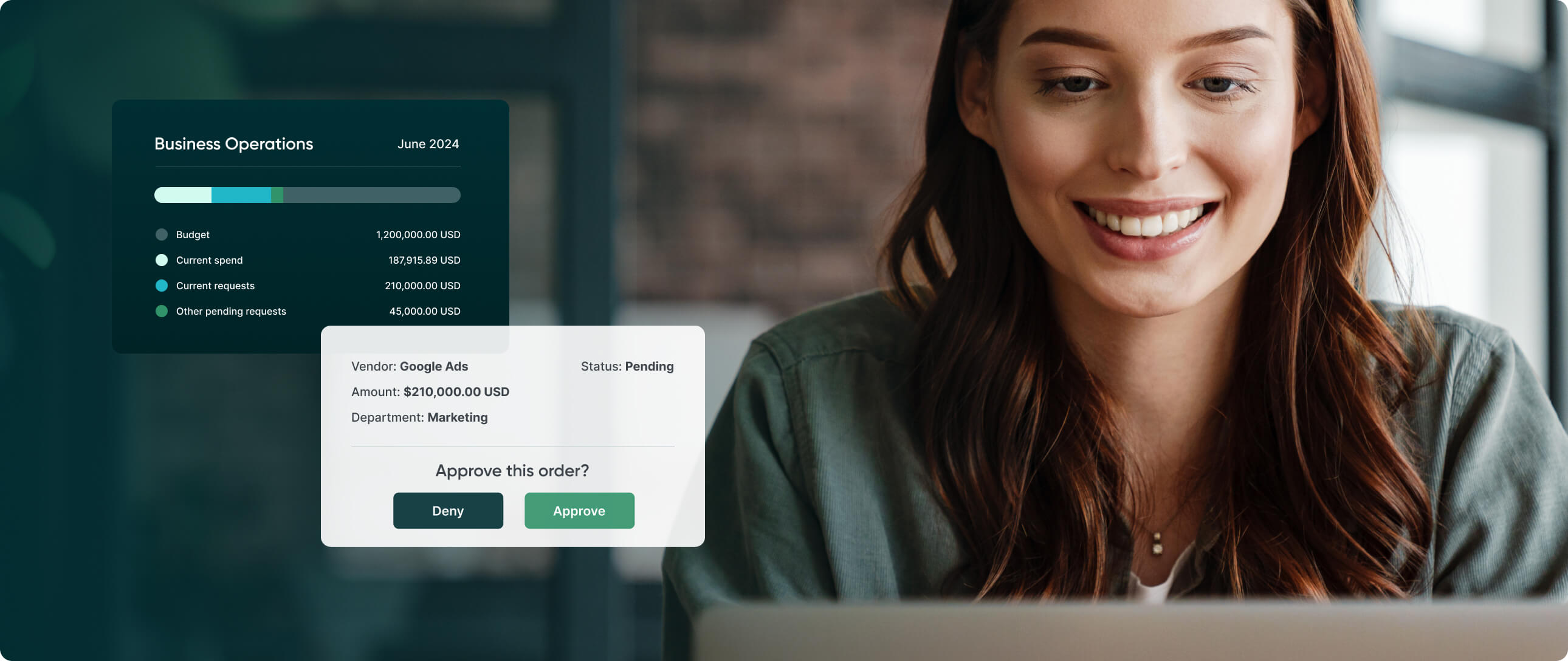

From rogue spend and manual processes to uninformed purchasing decisions, tackle AP and purchasing challenges that cost you time and money. Procurify helps your organization control and cut costs while driving operational efficiencies that free up time to focus on higher-value initiatives.

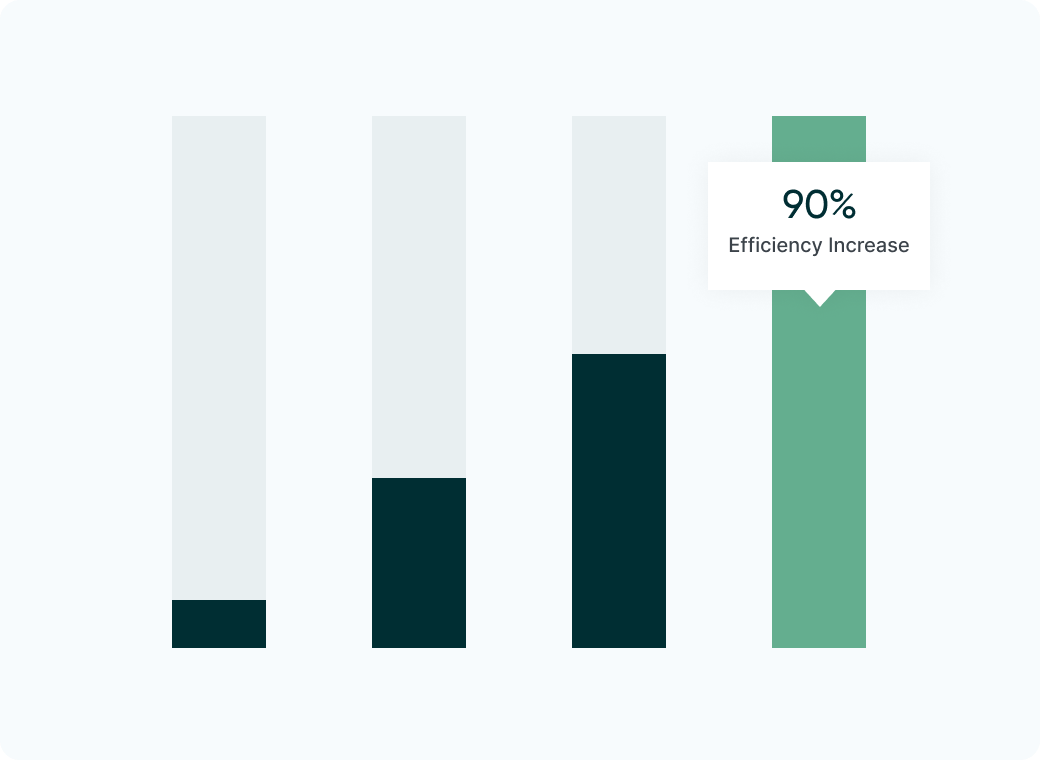

Minimize spend, maximize efficiency

Provide everyone in your organization with the tools to make more efficient and responsible spend decisions, saving time and money that can be reinvested into your business.

Why organizations choose Procurify

Procurify is the most complete, affordable, and easy-to-use procure-to-pay platform. We partner closely with clients to ensure the quickest possible time to value.

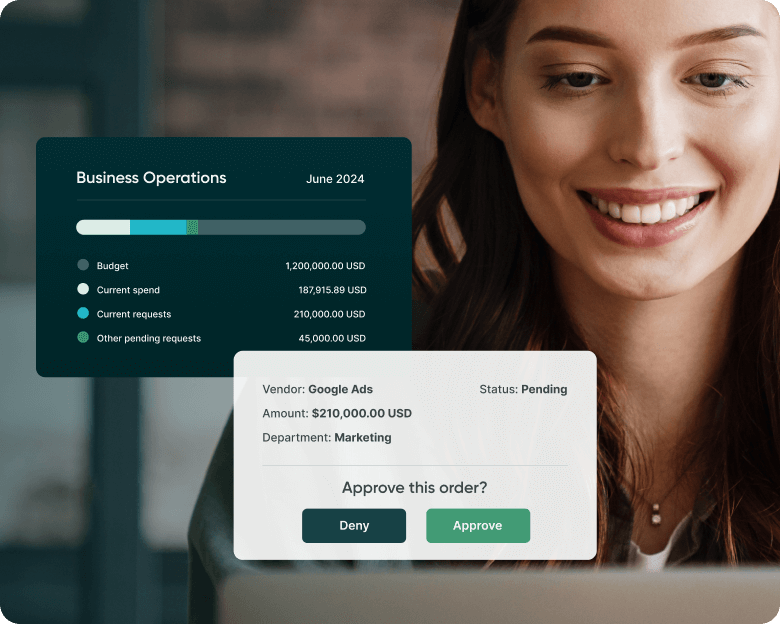

Take control of spend now

Book a personalized demo to see how Procurify makes it super easy for businesses to manage spend and save millions in time and money.